STEADILY INSURANCE

Steadily has got you covered.

We’ve teamed up with Steadily to offer our clients the best-rated landlord insurance in America. Discover who landlords nationwide saving time and money by switching to Steadily.

Steadily Product and Coverages

Steadily offers these policy types, in descending order of frequency:

Dwelling policy (DP3, DP2, DP1)

Umbrella

Builder’s risk

Renters

Tenant liability (forced-place insurance for tenants without renters insurance)

Flood

Earthquake

Inland marine (construction materials)

Commercial (apartment buildings)

Property types

All property types are supported including:

Mobile homes

Short-term rentals

AirBnB

Student housing

Vacant properties

Renovation / Construction / Vacant land

Apartment buildings

Typical coverages

The typical property Steadily insures is a single-family home with an insured property value of $200-250K and a liability limit of $500K. DP coverage maximums are typically $1-2M, depending on local property values. Higher limits are able to be insured if needed.

Landlord Insurance FAQ

-

Landlord Insurance is an insurance policy specifically designed to provide coverage for property owners who rent out their properties.

-

Landlord insurance covers property damage to rented properties caused by various perils, such as fire, theft, vandalism, and certain types of water damage.

It provides liability coverage for legal fees and medical expenses if someone is injured on the rental property.

However, it does not cover the loss or damage of the tenant's personal property.

-

Whether homeowner's insurance covers rental properties depends on the rental scenario:

• Frequent Short-Term Rentals: For setups like Airbnb or VRBO, where various guests stay for a short time, a commercial insurance policy is required.

• Infrequent Short-Term Rentals: If you occasionally rent out your primary residence for less than 30 days, you may be able to use your homeowner's policy with your insurer's approval.

• Long-Term Rentals: For typical long-term rentals, such as a 6-month or 1-year lease, a landlord insurance policy is necessary.

-

Landlord insurance and homeowner's insurance have key differences due to eligibility criteria. You generally cannot have both at the same time.

Landlord insurance provides coverage tailored to the higher risks associated with rental properties but offers less broad coverage than homeowner's insurance.

The basic levels of landlord insurance (DP-1 and DP-2 policies) cover less than the most common homeowner's insurance, while a DP-3 policy offers similar coverage to homeowner's insurance.

-

Yes, landlord insurance tends to cost about 25% more than homeowner's insurance for the same property.

The increased cost is mainly due to higher risks associated with tenant-occupied rental properties, which typically have more frequent and higher-value claims.

-

Landlord insurance typically does not cover:

• The tenant's personal property, which may require renters insurance.

• Damage caused by the property owner or intentional property damage.

• Repairs to major systems or appliances due to normal wear and tear or lack of maintenance.

• Damage from certain perils like earthquakes or floods, which may require separate coverage.

Please note that it is important to read the terms and conditions of your specific policy as coverage may vary between insurers.

Get coverage with Proper.

PROPER INSURANCE

Proper Insurance's commercial policy comes with a range of exceptional features tailored specifically to the Short Term Rental Investor.

Proper Insure Product and Coverage

Proper Insurance's commercial policy comes with a range of exceptional features tailored specifically to the Short Term Rental Investor:

Special cause of loss (all-risk) coverage for both the building and contents.

Replacement cost valuation ensures that your property and belongings are covered at their current value.

Standard $1,000,000 of commercial general liability coverage, with an optional $2,000,000 upgrade available.

No limit on damage caused by guests, theft, or vandalism.

Coverage extends to liability for amenities such as pools, hot tubs, bicycles, exercise equipment, and small watercraft.

Protection against liquor liability and pet-related incidents.

Actual loss sustained business income coverage with no time limit, ensuring you're covered for lost income due to covered events.

Additional enhancements, such as coverage for bed bug infestations and protection against squatters, including legal expenses and lost income.

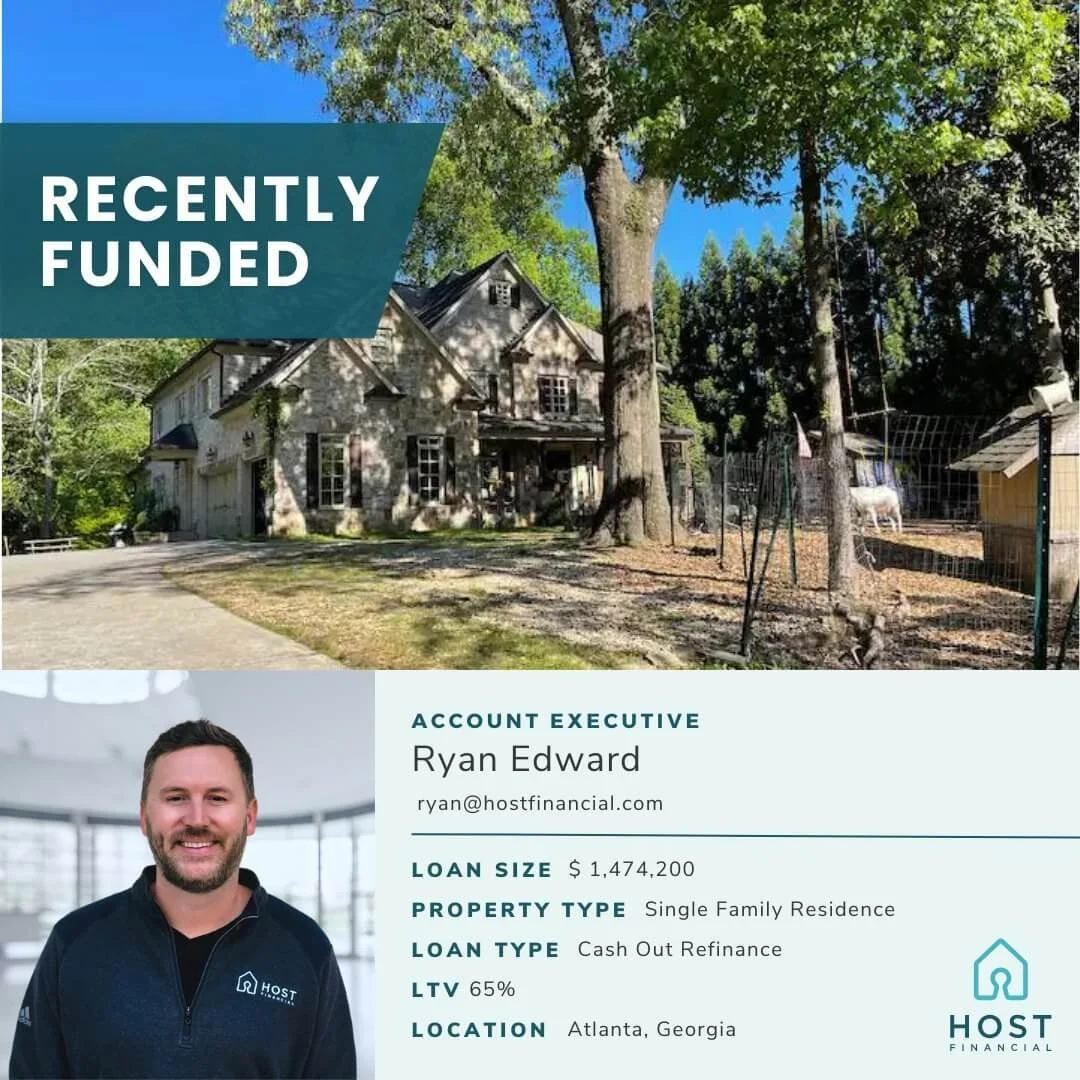

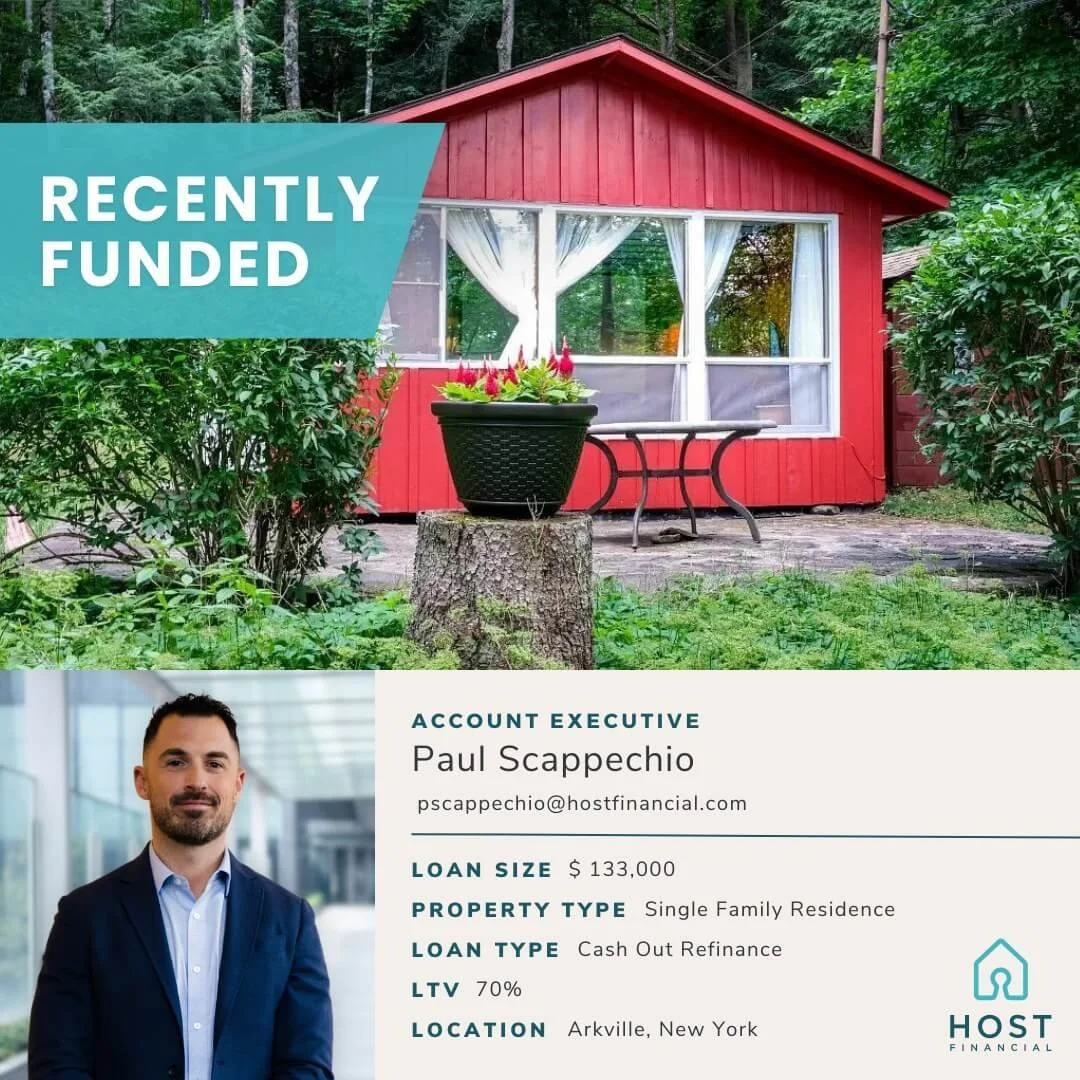

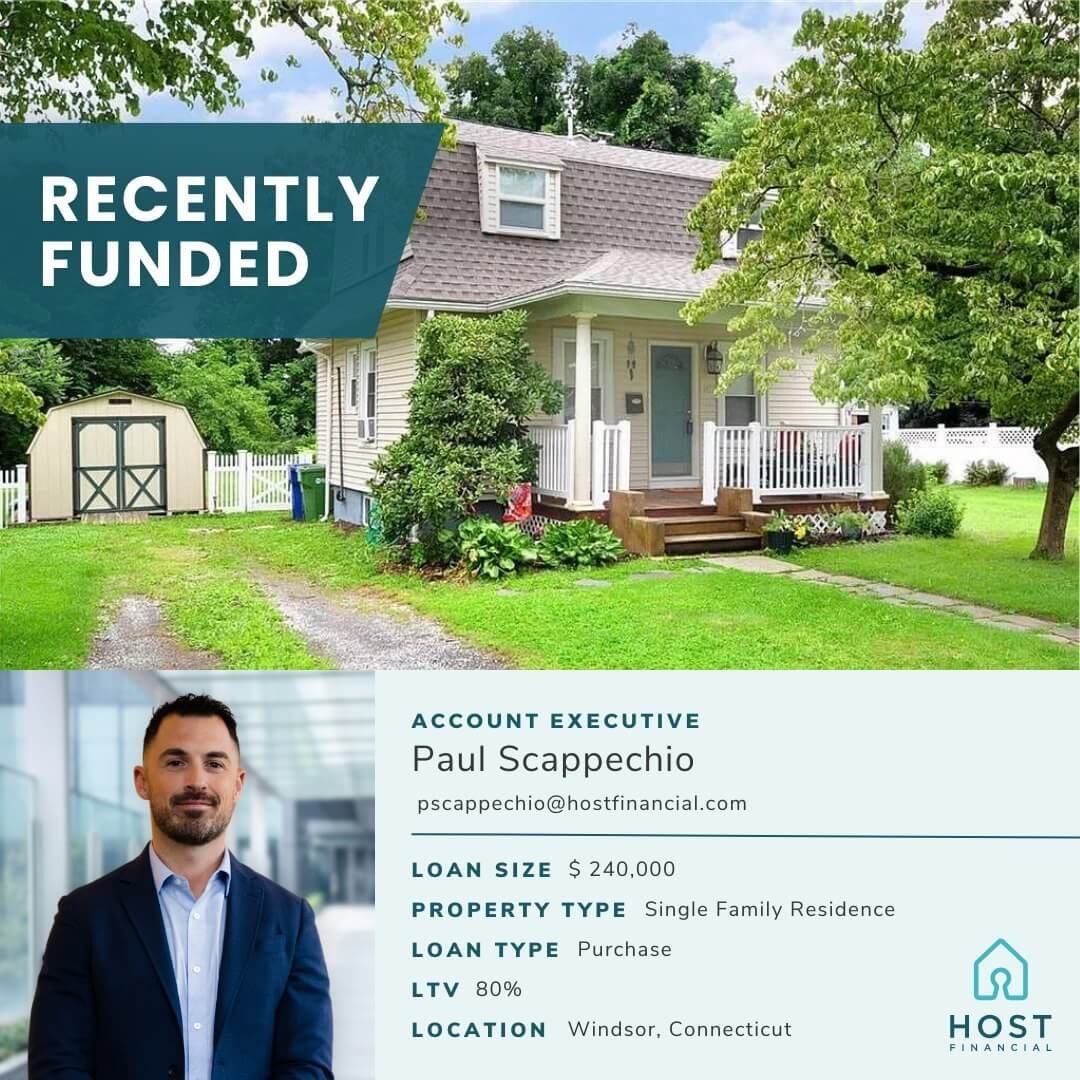

Recently Funded

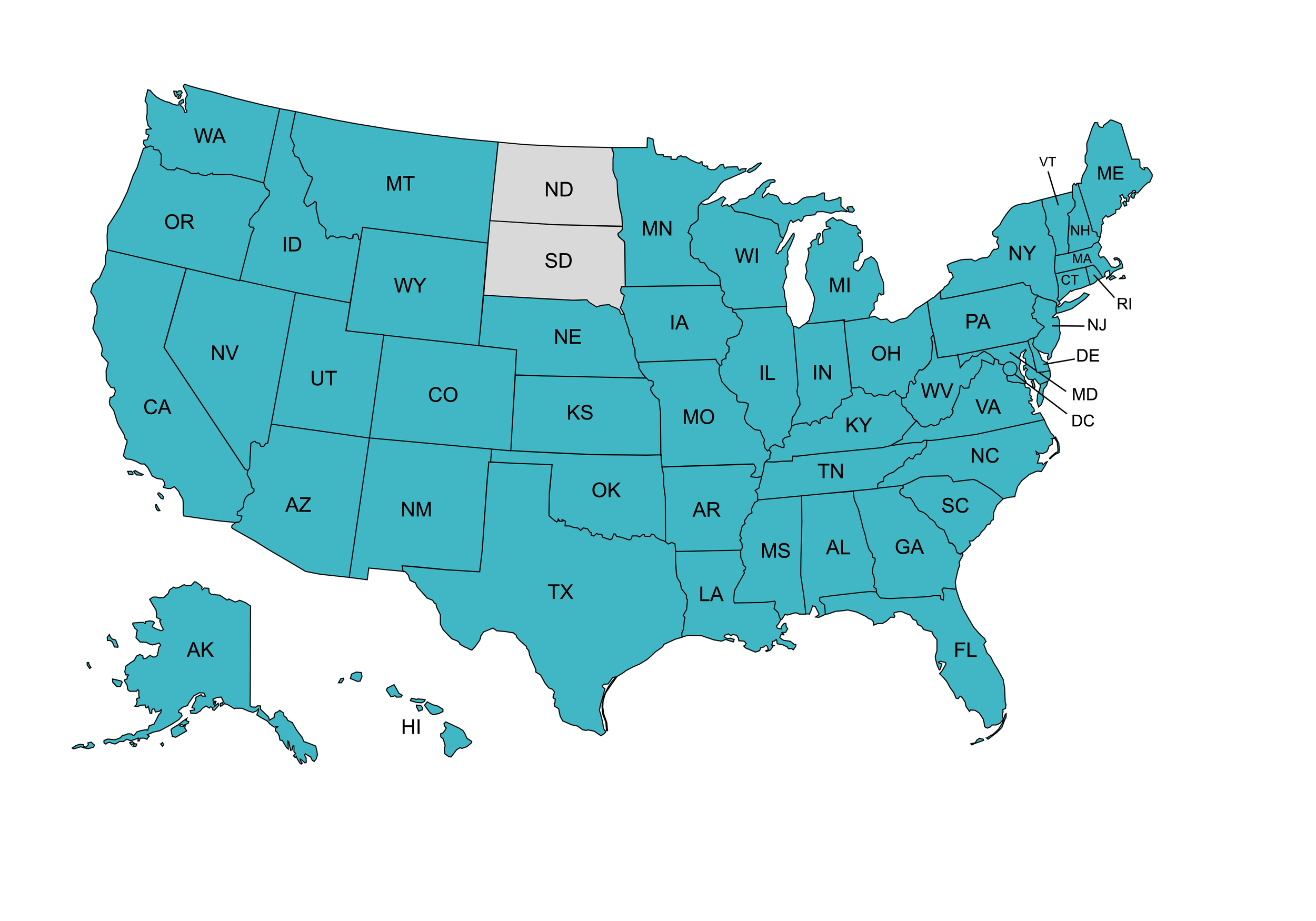

Curious to know if you can apply to get financing for your investment property in your area?

Check out all the sates we service and see if you could qualify! Our lending partners lend across the county in 48 states.