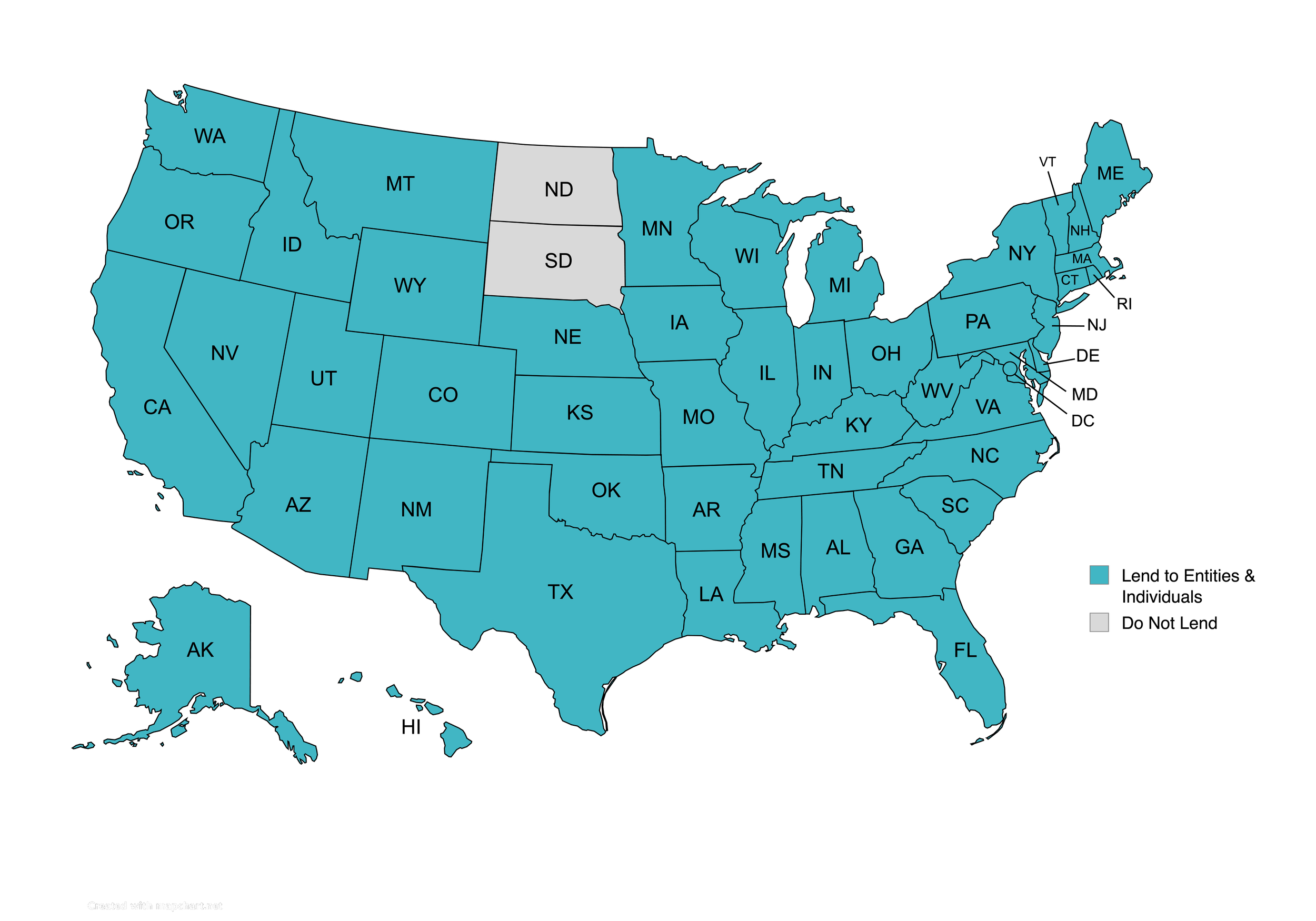

WHERE WE LEND

Lending Map

Our loan programs are approved in 48 out of 50 US States!

-

ALABAMA

ALASKA

ARIZONA

ARKANSAS

CALIFORNIA

COLORADO

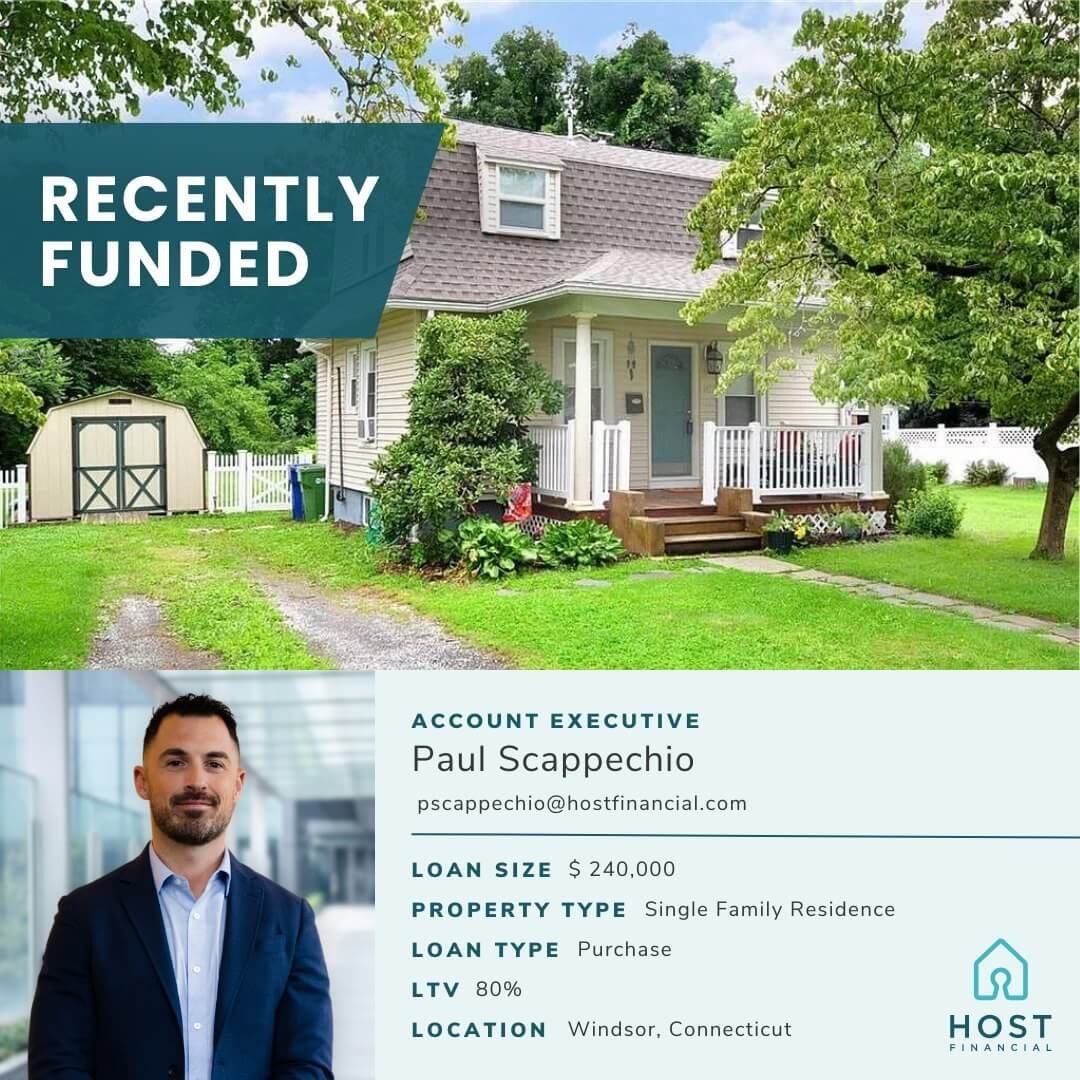

CONNECTICUT

DELAWARE

FLORIDA

GEORGIA

HAWAII

ILLINOIS

IDAHO

ILLINOIS

INDIANA

IOWA

KENTUCKY

LOUISIANA

MAINE

MARYLAND

MASSACHUSETTS

MICHIGAN

MISSISSIPPI

MISSOURI

MONTANA

NEVADA

NEW HAMPSHIRE

NEW JERSEY

NEW MEXICO

NEW YORK

NORTH CAROLINA

OHIO

OKLAHOMA

OREGON

PENNSYLVANIA

RHODE ISLAND

SOUTH CAROLINA

TENNESSEE

TEXAS

UTAH

VERMONT

VIRGINIA

WASHINGTON

WASHINGTON DC

WEST VIRGINIA

WISCONSIN

WYOMING

-

NORTH DAKOTA

SOUTH DAKOTA

Things to Consider if Vesting Under an LLC

☑ Where you form your LLC – in the state where the property is located vs the state you reside / file taxes.

☑ Some states may require a Foreign Entity Registration for our of State LLC's.

☑ Increased tax expense – returns required to be filed for each LLC

Foreign LLC Definition

A Foreign LLC is simply an LLC that was formed in one state (it’s “home state”, where the LLC is known as a Domestic LLC) that is registering to do business in a new state. When a business expands to operate out of, and do business in multiple states, it must register (or “qualify”) as a Foreign LLC in each new state where it wishes to operate.

Foreign LLCs and “Doing Business”

As to whether or not you need to register your LLC as a Foreign LLC in another state comes down to whether or not you are legally “doing business” in that state. Each state has different laws when it comes to the definition of “doing business”, so if you’re not sure whether you need to register a Foreign LLC or not, we recommend reaching out to a few attorneys for a quick chat.

Don’t see your question answered here?

We’re here to help. Fill out our contact form and we will get back to you with more information.