LONG TERM RENTAL LOANS

Receive financing for your rental property without worrying about your Debt-to-Income Ratio

Host Financial’s asset-based long term rental program is tailored for the investor that wants to scale their real estate portfolio without worries of being tied down by their Debt-to-Income Ratio. We take an asset-based approach to qualify your loan by looking at the lease or potential market rent of the property instead of your personal income. No W2s, tax returns, or personal income verification means fewer documents for underwriting which results in faster closings. These simple and easy qualifications reduce the barriers for purchase and refinance which allows you to scale into multiple properties quickly.

How to qualify

To receive a quote, you’ll need to know your:

Market Rental Rate or Tenant Lease Amount

☑

☑

Your Liquidity

Property Value and Purchase Price

☑

Asset Types

Single Family

Townhome

Condos

Duplex

Triplex

Quadplex

Multi-Family Home

Loan Terms

Loan Sizes: $100k up to $3.5 Million

Purchase LTV: Up to 85%

Rate & Term Refinance LTV: Up to 85%

Cash Out Refinance LTV: Up to 75%

Amortization: 30 Year Amortization Schedule

Terms: 5/6, 7/6 ARMs, 10 Year Interest Only, and 30 Year Fixed

Rates: 6.75%+ base rate (subject to change daily due to market volatility)

Full Recourse with personal guarantee required on all owners with majority shares (typically 20%+ or 25%+)

DSCR Requirement: 1.0 or greater depending on loan size and property type

Vesting: Lending to Individuals, LLCs, and Corporations

Average Time to Close: 14 to 35 days

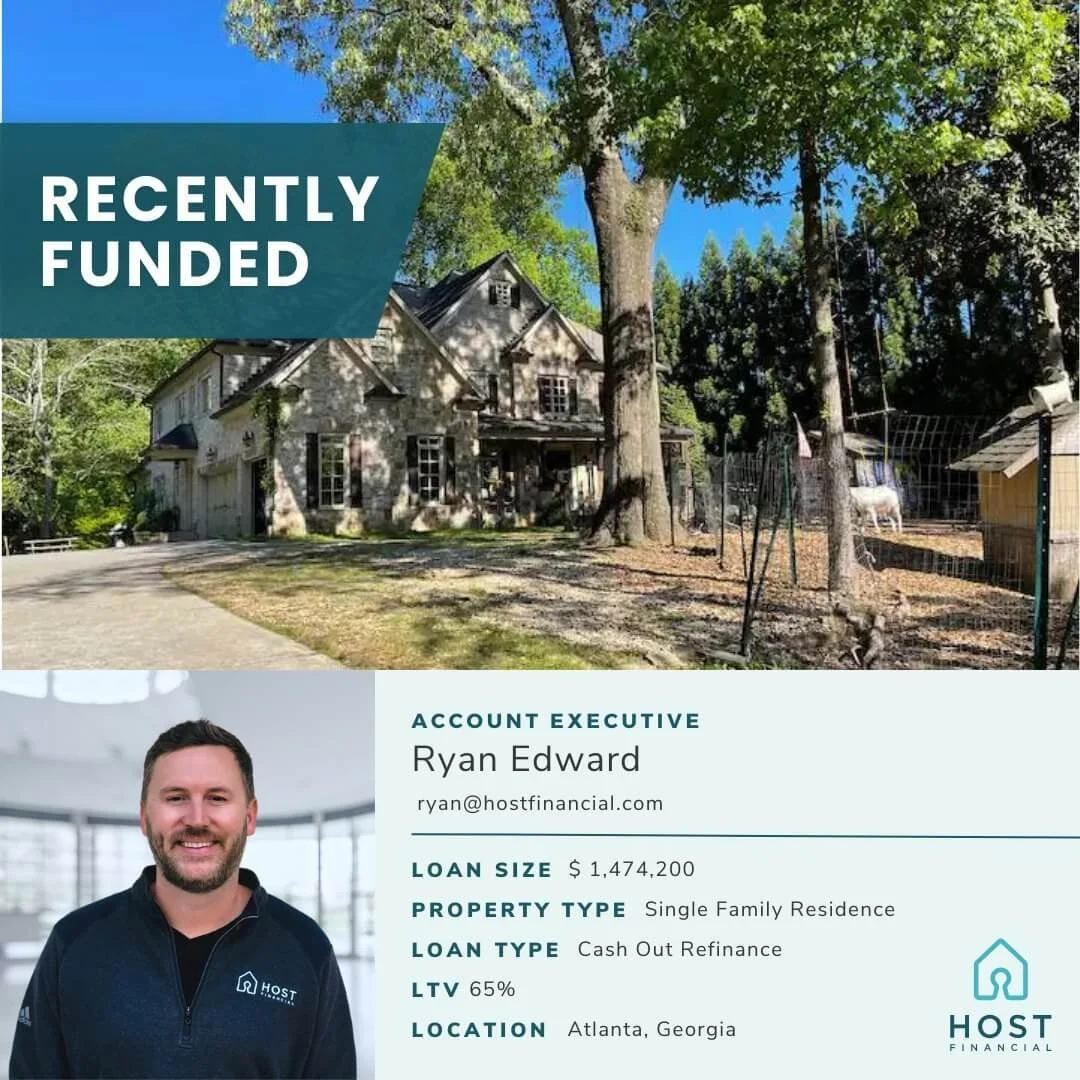

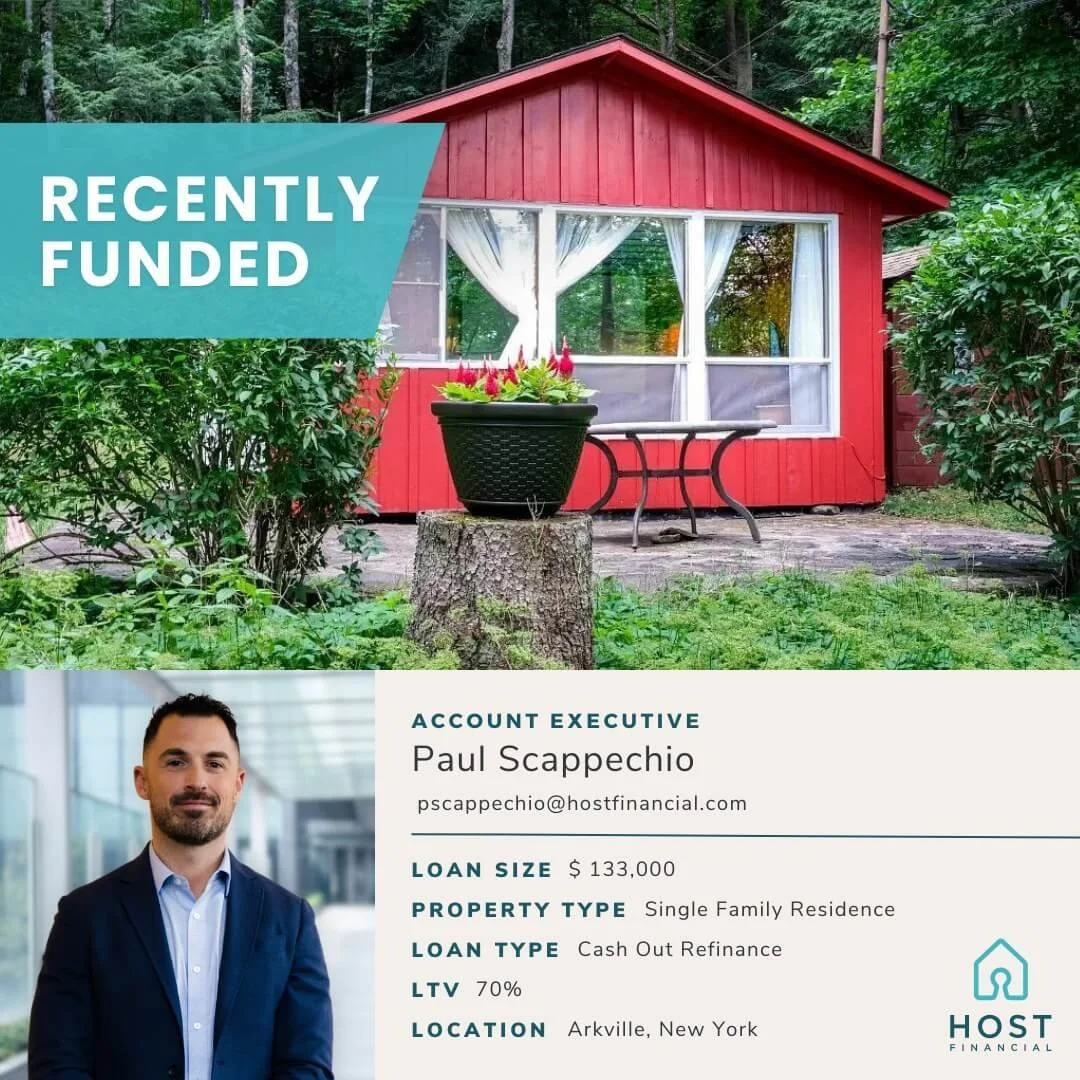

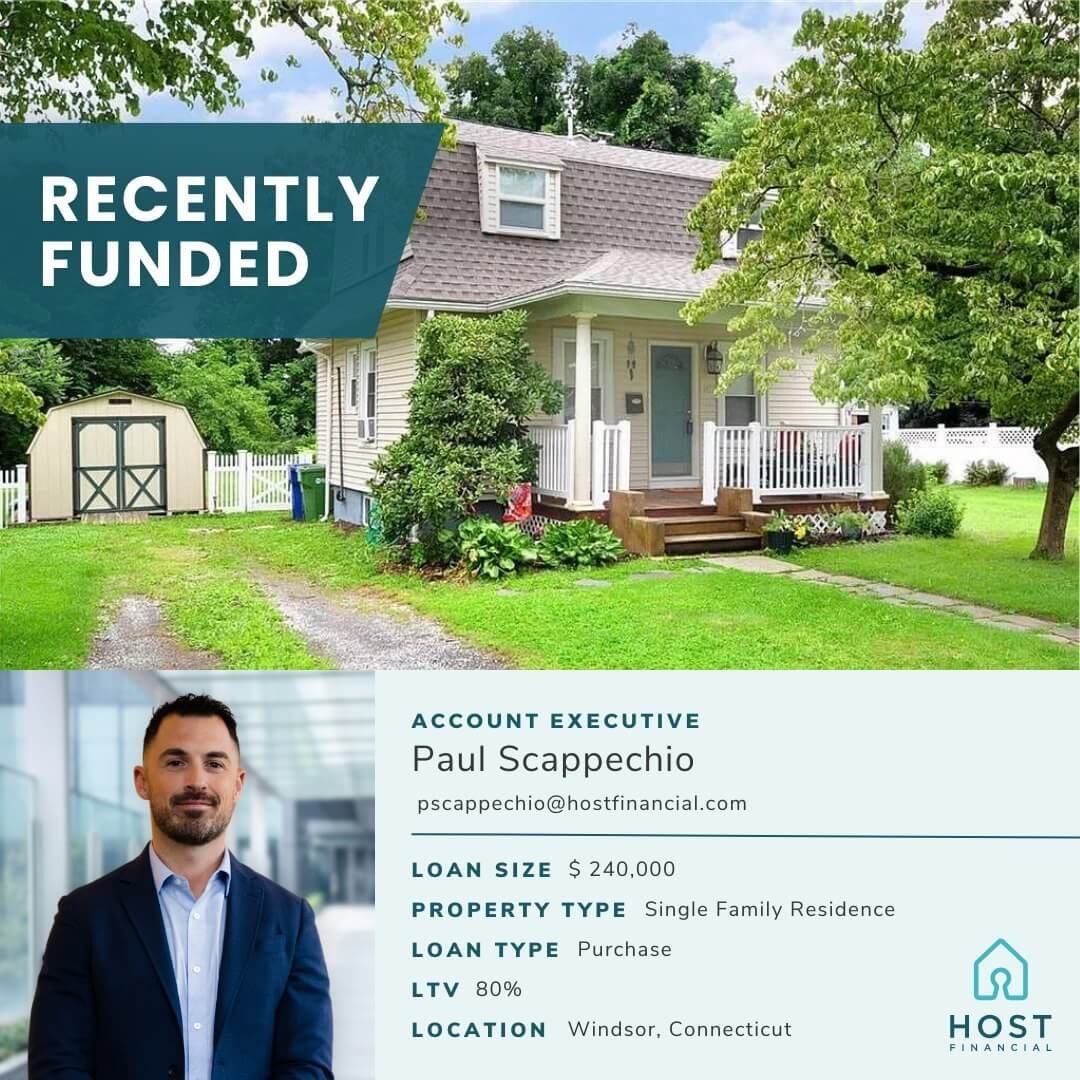

Client Success Stories

LONG TERM RENTAL LOAN FAQs

-

DSCR is calculated by dividing the property’s actual or projected gross annual income by its annual mortgage debt service (including principal and interest, property taxes, insurance and HOA fees). If the property is leased, the lease amounts can be used so as long it's no more than 25% higher than market rents. For unleased purchases market rental rates will be used from the 1007 market rental survery done during the appraisal process. A DSCR ratio of over 1 means the property generates enough income to cover its debt obligations. Host Financial can finance deals with DSCRs .75 or below. 75 to .99, 1.00+, 1.25+ and above. In the rate calculation DSCR ratio plays a factor so for the best rates not withstanding of other qualifying factors (FICO, loan size, property type, LTV, etc), a DSCR ratio of 1.25 above would be considered a top tier bracket for rates.

-

Host Financial provides financing for various properties suitable for short-term rentals, including single family residences, condos, townhomes, duplexes, triplexes, quadplexes, and multi-family properties up to 20 units.

-

Host Financial typically requires a minimum credit score of 620 for short-term rental financing. However, for the best LTV, rate, and term options a credit score of 680+ is preferred.

-

The approval process at Host Financial involves submitting a request for a quote, selecting the loan term and option to move forward with, proceeding with an application, providing documents for under writing such as entity docs (if vesting under an entity), driver's license, 2 months bank statements for liquidity verification, insurance policy quote, title report, and payment for appraisal inspection. Once borrower files, insurance policy, title reports, and appraisal report is submitted the loan will go into final underwriting and qualify control. Once approved, we prioritize a swift and efficient closing process that takes five to ten business days.

-

Host Financial offers flexible loan terms tailored to the unique needs of short-term rental investors. Choose from 30 and 40 year amortization options with 5/6arm, 7/6 arm, 10/6 arm, 10 year IO, and 30 year fixed options.

-

Yes, a down payment is required. The amount may vary based on factors such as credit score, property type, and loan amount. Host Financials' team collaborates with you to determine the most favorable terms for your specific situation. Typical down payments range from 15 to 25% down.

-

No, once Host Financial finances the property, you have the freedom to use it for rentals as planned.

-

Absolutely. Host Financial takes into account projected market rents when quoting and offering preapproval letters. The final number used for underwriting will be confirmed via the appraisal 1007 market rental survey report.

-

Host Financial offers short-term rental financing with prepayment penalties ranging from 1 year to 5 years. Structures include option from a 5% or 3% flat prepayment penalty each year for the lenght of the pre-payment period term or a declining structure such as a 5/4/3/2/1, 5/4/2, 3/21, 3/0/0 (examples, not all inclusive).

-

Host Financial is committed to a smooth and timely closing process. While timeframes may vary, we strive to close long-term rental loans efficiently, typically within 25 days. The main timeframe hurdles for closing a loan that are outside of the borrowers control is the turnaround time on appraisal reports. In a cases in which insurance, title, appraisal report, and borrower side documents are turned in quickly closing can occur within one to two weeks from receipt of the complete list of files.

-

• One Stop Shop For DSCR Financing: In our current dynamic market environment, rates and even qualification guidelines change daily. Host has access to multiple capital partners and will price the entire market ensuring you get the best rates and terms available.

• Should rates changes mid process we can quickly switch capital partners to get a lower rate.

• Should guidelines change mid process you won’t be stuck with a lender that has one set of guidelines which could kill your deal and put you back to shopping the market. This ensures we have the highest chance of closing on deals where others can’t.

• Host Financial are the experts in DSCR financing: 95% of our deals are for DSCR loans for rental investment properties. Working with Host ensures you know you’re working with a lender that gets it and can get the deal done. We’ve seen and done it all.

• Privacy & Asset Protection: With the ability to vest in an entity you can protect your identity and assets from the risks and liability involved with running a long term rental property.

• Most coverage: Host lends in 48 states nationwide.

Don’t see your question answered here?

We’re here to help. Fill out our contact form and we will get back to you with more information.

Recently Funded

Curious to know if you can apply to get financing for your investment property in your area?

Check out all the sates we service and see if you could qualify! Our lending partners lend across the county in 48 states.