SHORT-TERM RENTAL LOANS

Simplified

*Applying does not affect credit score.

We’re a company built by real estate investors and entrepreneurs, just like you. We’ve experienced first-hand how frustrating it can be to secure financing for short-term rentals when traditional lenders just don’t get it. That's why we founded Host Financial. Are you ready to expand your real estate empire with investor-friendly short-term & long-term rental financing?

FEATURED IN

We saw that traditional financing wasn't designed to support ambitious entrepreneurs looking to build their short-term rental and investment property portfolio quickly.

So, in collaboration with our capital partners, we created a program that underwrites loans based on the property’s income, rather than the investor’s personal income. Say goodbye to pesky DTI restrictions and hello to unlimited potential. Our loan process is simple, efficient, and doesn't require any of that tax return or personal income statement nonsense.

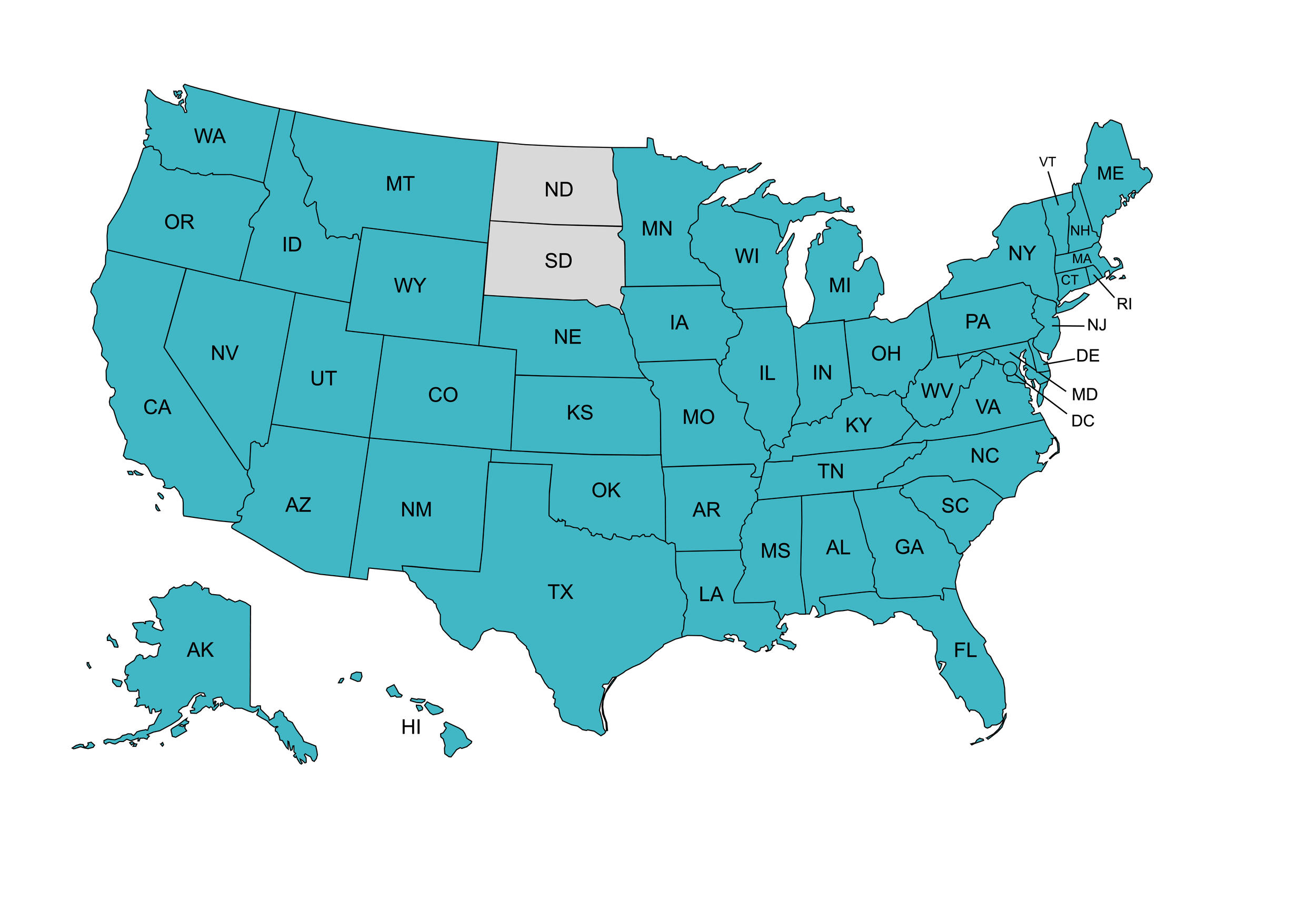

WHERE WE LEND

Lending Map

Our loan programs are approved in 48 out of 50 US States!

-

ALABAMA

ALASKA

ARIZONA

ARKANSAS

CALIFORNIA

COLORADO

CONNECTICUT

DELAWARE

FLORIDA

GEORGIA

HAWAII

ILLINOIS

IDAHO

ILLINOIS

INDIANA

IOWA

KENTUCKY

LOUISIANA

MAINE

MARYLAND

MASSACHUSETTS

MICHIGAN

MISSISSIPPI

MISSOURI

MONTANA

NEVADA

NEW HAMPSHIRE

NEW JERSEY

NEW MEXICO

NEW YORK

NORTH CAROLINA

OHIO

OKLAHOMA

OREGON

PENNSYLVANIA

RHODE ISLAND

SOUTH CAROLINA

TENNESSEE

TEXAS

UTAH

VERMONT

VIRGINIA

WASHINGTON

WASHINGTON DC

WEST VIRGINIA

WISCONSIN

WYOMING

-

NORTH DAKOTA

SOUTH DAKOTA

Loan Programs

POWERED BY

Short-Term Rental Calculator

POWERED BY

Our Process

1

Submit your request for a quote and we will do a comprehensive analysis to get you’re the best rates and terms available.

INQUIRY

2

Host Financial will guide you through a simple checklist of documents we need to collect in order to submit your loan to processing with the underwriting team.

PREPARATION

3

After your initial docs have been submitted, your account executive will order the appraisal and underwriting will begin their due diligence.

UNDERWRITING

4

FUNDING

Sign documents and close!

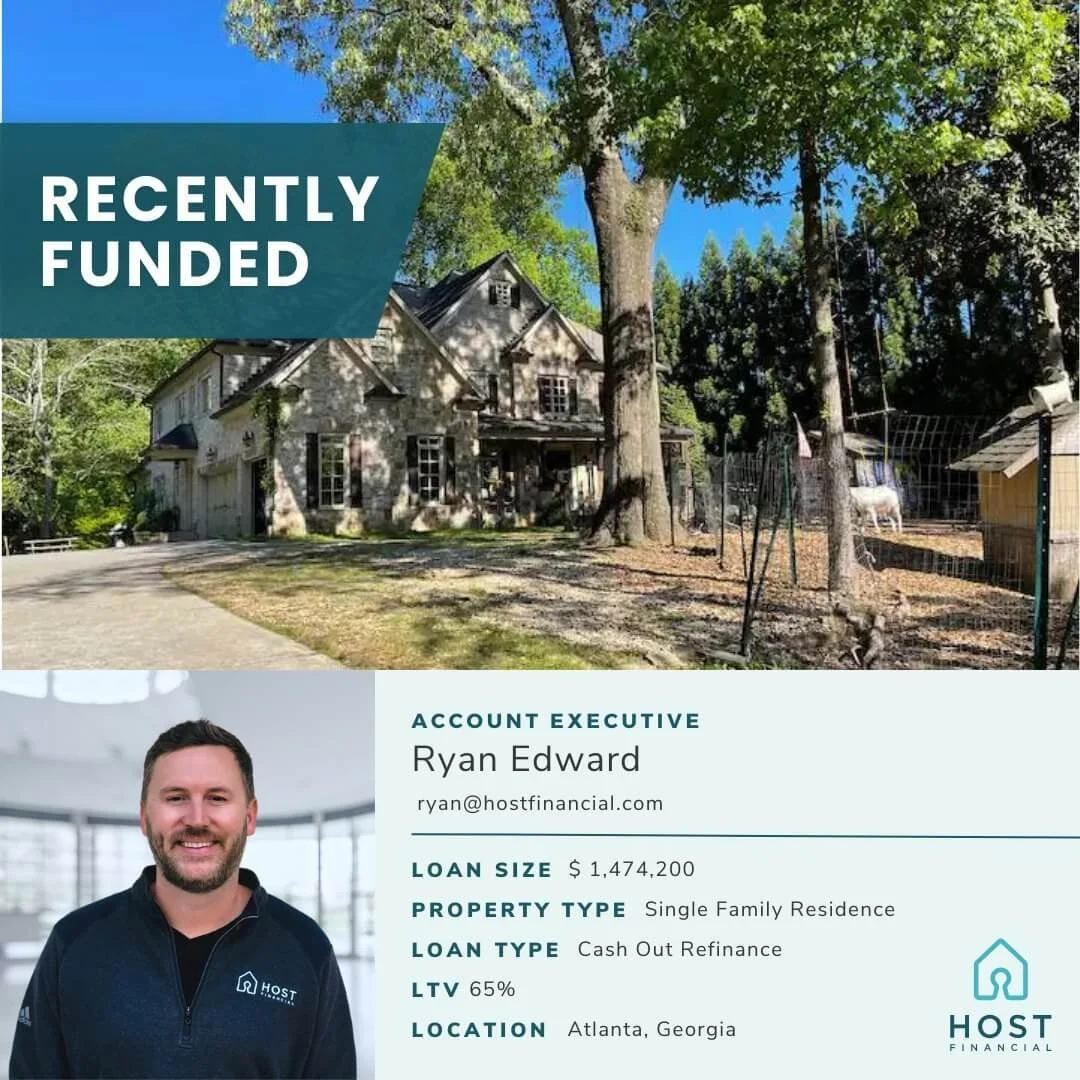

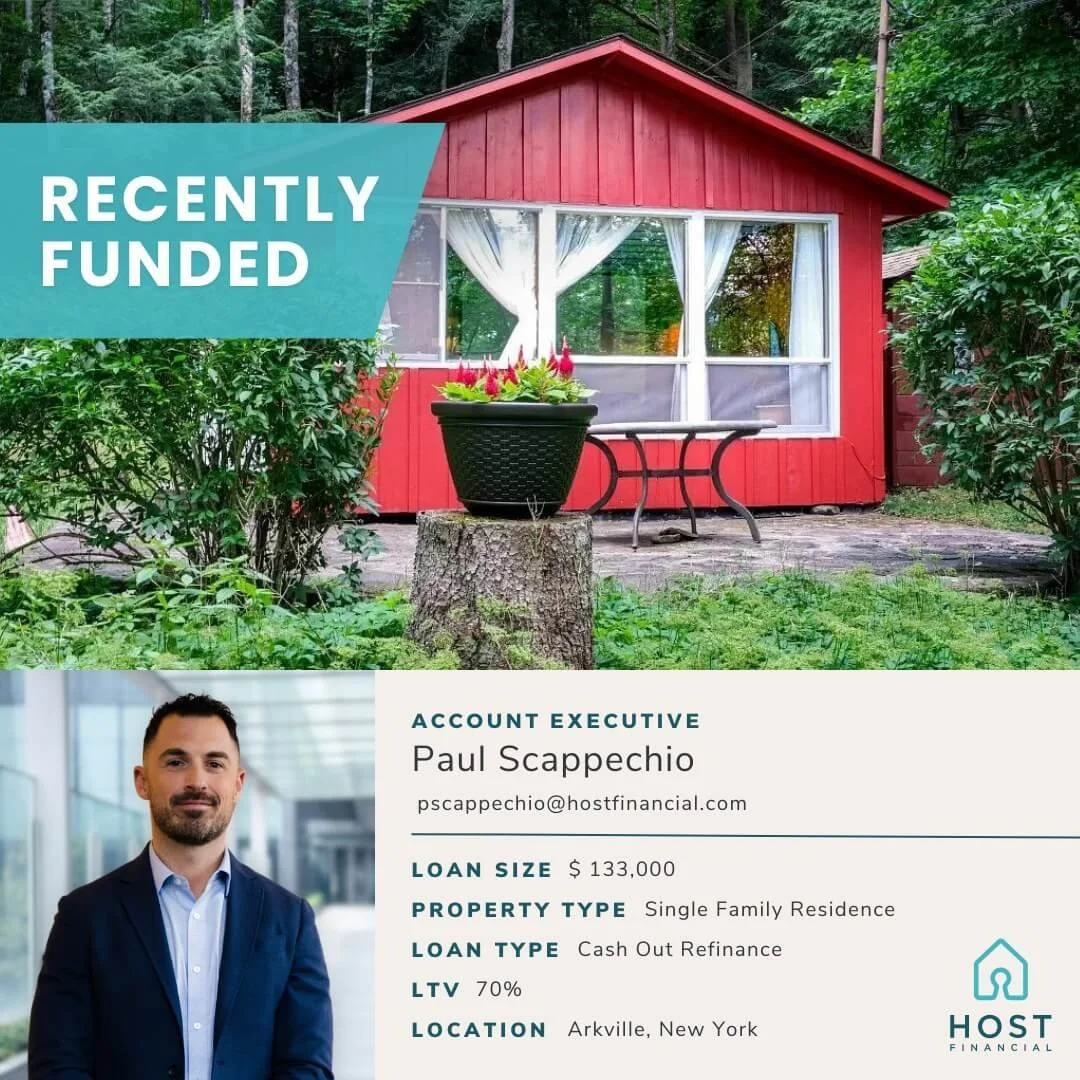

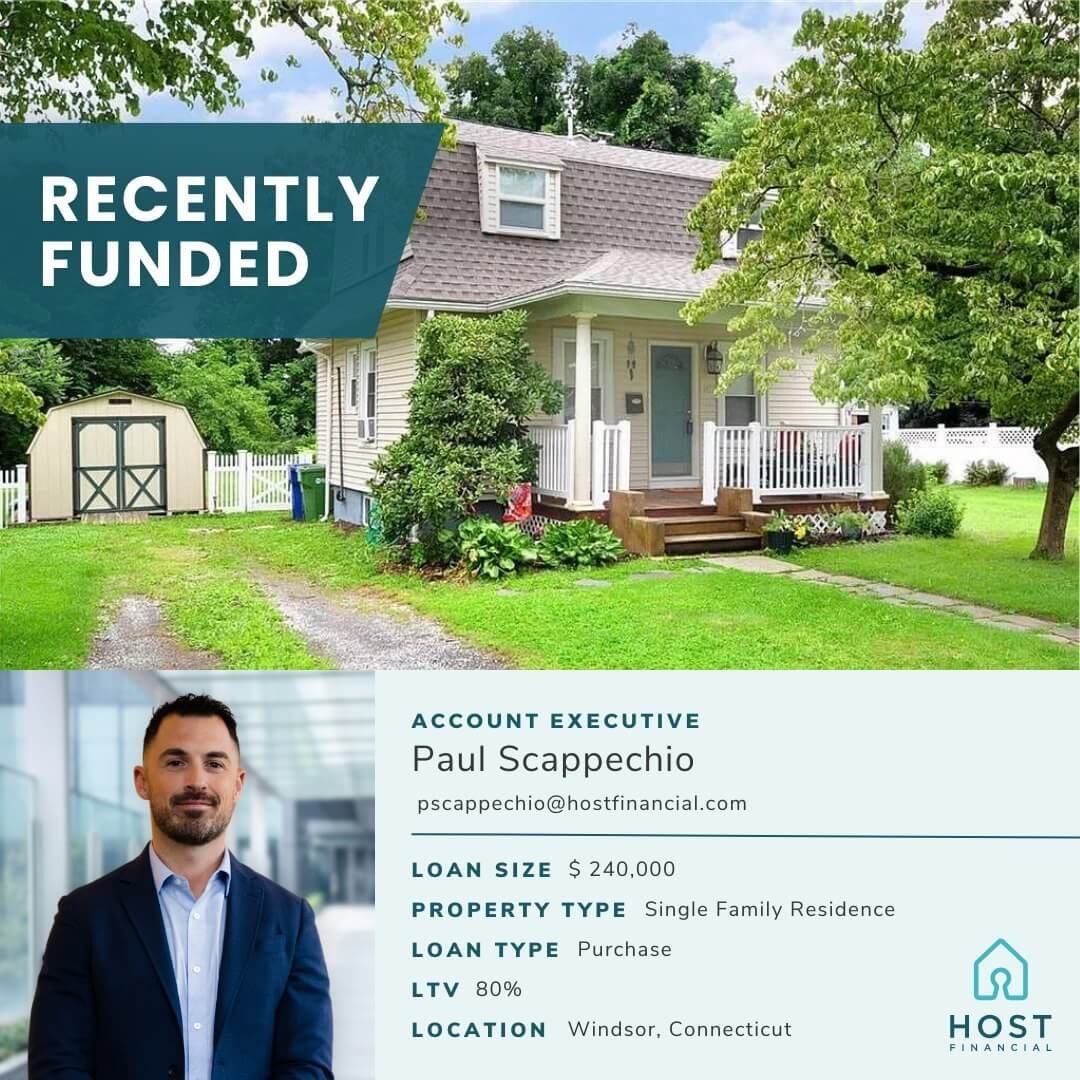

Client Success Stories

We understand what matters to investors

Transparency

We're not some stuffy bank using complicated jargon and hidden fees. At Host Financial, we keep it real. No fluff, no filler, just clear and concise communication in plain English.

Common Sense

Unlike traditional financing, our 3 factors to qualify for loans make financing simple. You can qualify with the property's income, your FICO score, and your liquidity. Simple as that.

Versatility

Our investors have unique needs for different situations, so we don't just offer loan solutions for short-term rentals; we also work with long-term rentals, rehab, remodel, construction loans and BRRRR take outs.

Privacy & Protection

Protecting your identity and assets as an investor can also be extremely important, so our we also offer solutions for corporate entities, not just individuals.

Our founders are investors, just like you.

When our founders, Daniel and Adam, found out that traditional financing wasn't designed in a way that supported entrepreneurial investors like themselves, they decided to search for a solution. And since they didn’t find one, they created one. Together, they put together a program that underwrites loans based on short-term rental income, not just an investor's monthly income.